Too Much TV: Your TV Talking Points For Tuesday, July 18th, 2023

A look ahead at Netflix's Q2 earnings report

Here's everything you need to know about the world of television for Tuesday, July 18th, 2023.

A LOOK FORWARD AT NETFLIX EARNINGS

Netflix will announce its Q2 earnings tomorrow after the close of the stock market and the expectations are the subscriber growth and revenue might be higher than the company had originally guided during last quarter's call.

I was going to put together my own list of questions I would like to hear addressed during the executive call with investors. Which typically doesn't accept questions and whose overall worth to journalists aside from whatever prepared comments the executives offer up is minimal.

There are are so many things I want to ask. But I ran across two people with similar ideas today and their questions are worth highlighting here:

Kasey Moore runs Whats-On-Netflix and given that expertise, the questions are really on topic:

1. Licensing ramp up - are there previous doors that were shut (HBO) now open to licensing more series and movies?

2. Strikes - is licensing going to play more of a role on this front to fill the hole? Will resources be allocated more to international projects instead? What are the thoughts within Netflix about how to conclude strikes amicably?

3. Originals slowdown - we've seen this year already less Originals released (particularly on the movie side) with a more uniform release (big show on Thursday - movie on Friday) - is there any experimentation left to do?

4. Split season release schedule - why are some series releasing in this format showing poor viewing numbers?

5. Password crackdown - has this finished rolling out globally? Any key lessons learned? When do you expect competitors to follow suit? 6. Netflix Games - any additional information on how well current roster of mobile games is going, what the internal teams are working on and future product updates.

All of these are great questions and the password crackdown is especially relevant, given that Netflix is expected to report stronger-than-expected subscriber growth in North America - in large part as the result of the streamer's crackdown on password sharing. But it many territories, the crackdown has had a short-term negative impact on subscriber numbers. And it's notable that in India, Netflix hasn't attempted to crackdown on password sharing, even though it is a very common situation. In fact, entire businesses have been built around allowing people to "rent" a profile on various streamers.

The three analysts at Lightshed Partners have ten questions of their own for Netflix and while some of them overlap with Kasey's, these are definitely worth highlighting:

1) Franchises vs. Originals. Two years ago, investors criticized Netflix for not being able to create franchises relative to Disney’s Marvel and Star Wars franchises. Now, Disney is being criticized by investors for not being able to create fresh original IP like Netflix. Curious how you think about franchises and how you avoid using historic success of franchises as a crutch to avoid creating new, original IP?

2) Would Netflix Go Free in India? Disney appears to be throwing in the towel in India (link) with Star TV set to lose hundreds of millions in 2024 (after making hundreds of millions a few years ago). JioCinema has crushed Hotstar, leveraging the power of free IPL supported by advertising. Curious if JioCinema’s success has changed your view of offering a free ad-supported tier in India, particularly now that you have launched an advertising business? Related, are there other markets you could see a free ad-supported product working, such as Germany or Japan?

3) Why is $7.99 the right price for an additional household member? Given that the $6.99 AVOD tier’s ARPU is > $15.49 and the lowest ad-free tier is $9.99, why did you settle on $7.99 for an additional household member? How do you expect this price to evolve over time?

4) How innovative can your advertising products become? We were excited by your upfront announcement that brands could buy ads on the Netflix Top 10 daily, country by country (as we discussed in our post Netflix Goes on Offensive to Upend Ad Industry). Can you discuss other advertising units/products you plan to pursue over the coming year that differentiate Netflix from linear TV? How should we think about the advertising ARPU long-term? Can it grow from $8.50 today to low-mid teens over time?

5) Microsoft Partnership Update. We have heard brands are not particularly pleased with Microsoft’s video advertising platform that Netflix utilizes. What are you doing about those challenges? How time and cost-intensive would it be to build your own ad tech stack?

Tomorrow's newsletter will obviously focus a lot on what comes out of the Netflix earnings call. It should be interesting.

RESIDUALS ARE COMPLICATED

The idea of residuals is something that most members of the general public can understand. And I think it's clear that both actors and writers feel the rates need to be higher. Honestly, I think that's a legitimate argument.

But I continue to struggle with understanding the reasons for the vast gap between what the minimum basic agreement (MBA) agreed to by the WGA, SAG-AFTRA and AMPTP should mean for actors and writers and what they report receiving. From what I can tell, a lot of the disparity comes down to how each side defines certain types of work. But when I see an actor who was a regular on a streaming show post a worldwide residuals check of just a couple of dollars, I still can't figure out what machinations were involved to get to that point.

And as a reporter, I'll say that the unions haven't seemed especially interested in walking me through some of this. Obviously they are busy right now. But it's also a core issue talking point in their public relations push. So I'm not sure that "you've read the MBA, I'm sure you can figure it out" is the approach I would take with reporters (and that's what I heard today from someone at one of the unions).

I think the assumption is that reporters writing about the subject should know the ins-and-outs already. But given that most union members I speak with have no idea how they work in detail, I'm not sure that expecting a deep expertise from journalists makes sense.

ICYMI ON ALLYOURSCREENS

Here's a rundown of some of the coverage from AllYourScreens that posted earlier today:

* What would happen if a hedge fund bought a broadcast TV network? Spoiler: It's Not Good News

* Wilderness is a new scripted series premiering on Prime Video this fall and it stars Jenna Coleman, Oliver Jackson-Cohen, Erica Balfour and Ashley Benson. Here are first look photos from show.

* And here are some first look photos from The Other Black Girl, which premieres September 13th on Hulu.

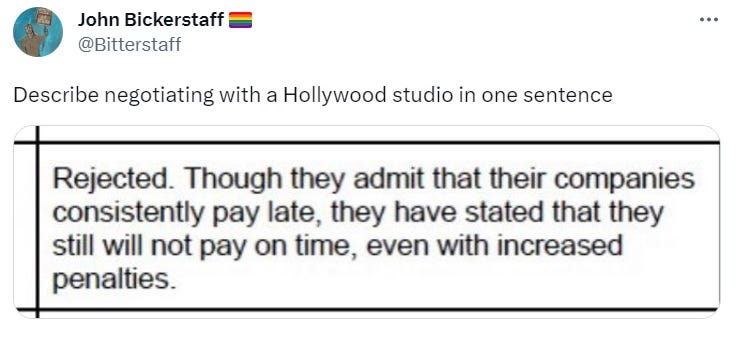

TWEET OF THE DAY

ODDS AND SODS

* In his Substack Episodic Medium, Myles McNutt takes a look at how SAG-AFTRA's call for solidarity became a morality test for fans and content creators.

* Peacock's Killing It returns for a second season on August 17th.

* If there has been a Taylor Swift concert near you, you've likely seen some variation of the "Taylor Swift Brings A Boost To Local Economy" story. But as Pat Garafolo notes in his fabulous Boondoggle Substack, you shouldn't believe what you read.

WHAT'S NEW FOR TUESDAY AND WEDNESDAY:

TUESDAY, JULY 18TH:

* Dark Side Of The 2000's (Vice)

* Down To Earth With Zac Efron Series Broadcast Premiere (The CW)

* Fantastic Friends Series Premiere (The CW)

* I Wanna Rock: The 80s Metal Dream (Paramount+)

* Justified: City Primeval Series Premiere (FX)

* Love Island USA Season Premiere (Peacock)

* Silent Witness (Britbox)

* Southern Storytellers Series Premiere (PBS)

* Surf Girls Hawaii Series Premiere (Prime Video)

WEDNESDAY, JULY 19TH:

* CMA Fest (ABC)

* Court Cam Season Premiere (A&E)

* Kalvin Phillips: The Road To City (Prime Video)

* Mayans M.C. Series Finale (FX)

* Teen Mom: The Next Chapter Season Premiere (MTV)

* The (Almost) Legends (Netflix)

* The Deepest Breath (Netflix)

Click Here to see the list of all of the upcoming premiere dates for the next few months.

SEE YOU WEDNESDAY!

If you have any feedback, send it along to Rick@AllYourScreens.com and follow me on Twitter @aysrick.