Too Much TV: Your TV Talking Points For Tuesday, March 14th, 2023

Today is apparently Data Point Tuesday.

Here's everything you need to know about the world of television for Tuesday, March 14th, 2023.

THERE'S VIEWING DATA AND THEN THERE'S VIEWING DATA

One of the most common complaints you hear from people in the television industry is the lack of accurate viewing numbers from the various streaming services. These are people accustomed to the "good old days" of linear television where the easiest way to quantify whether a show was a hit or miss was to look at the Nielsen Ratings numbers. In an ad-supported world, how many people were watching a show was a good metric for determining whether a show was going to succeed. At least from the viewpoint of the networks. More viewers equaled more ad revenue. Sure, there were other factors determining whether a show returned for another season. More than one otherwise successful series was canceled because the star was a jerk or the cost of the cast made the show less profitable. But generally, higher Nielsen numbers generally meant more success.

The streaming world doesn't have any metrics that translate quite so elegantly. Because most major streaming services are primarily ad-free, the number of people who watch any individual show is only one of the factors that determine success. It's also the type of viewers and their location, whether or not a show drives new subscribers or helps with churn and maybe a dozen other pieces of information. And for the most part, none of this data is public.

But just because the data is more opaque doesn't necessarily mean it's not available privately. I spoke today with a couple of people at Parrot Analytics, who walked me through some of their methodology. I'll write more about in a future newsletter, but what is clear is that analytics firms such as Parrot can provide some in-depth valuation and engagements estimates for content. While a showrunner or other members of the cast and crew might not have a sense of how many are watching their show, a studio or network can figure it out using this third-party data.

One of the challenges from my point of view is that while the data is being collected, it's generally not shared publicly and that tends to lead to a lot of ill-informed reporting. Without mentioning the show, one example is a streaming series that was recently dropped by a major streamer after what seemed to be an especially successful first season. The studio was unable to place the show at another outlet and the series died after its premiere season. Much of the reporting around the decision focused on the content of the show and the speculation was that the subject matter made the streamer uncomfortable. Or at the very least, the streamer was not supportive enough of the show's point-of-view.

I was speaking with someone at that streamer the following week and I was told off the record the reasoning behind the decision. Which was very much driven by some internal data. I later spoke with someone on the studio side, who confirmed the data I had been shown was basically accurate. And that data was a primary reason why no other streamer wanted to pick up the show.

While I appreciated the insight, it was a frustrating situation because I had a lot of insight I couldn't report out to viewers. So the ill-informed cancellation stories have been repeated in the weeks since the decision was announced and no one has stepped forward to correct the record.

So from a strictly selfish standpoint, I am less concerned with more transparency with viewing numbers and more focused on trying to pull back the curtain on other metrics. Most people in the industry still don't have a sense of how the streaming business really works. And that's a big problem as we head towards a possible writer's strike that may be driven in part by a desire to see more viewer data from the streamers.

PHILO OFFERS UP SOME VIEWING DATA OF ITS OWN

The entertainment-centric vMVPD service Philo recently commissioned a segmentation survey conducted by the firm Interpret, which took a deep look at key characteristics and demographics of Philo users who are heads of households with one or more paid streaming subscriptions. 73% of Philo’s audience falls in the 35-65 age range and skews female at nearly 60%.

Their subscribers are bunched into unique viewing segments and it's interesting to see the differentiations in what they watch as a group.

For instance, one group of Philo subscribers is defined as "Heavy Omnivores," a segment that comprises 16% of Philo subscribers. This segment has an average age of 43 years old with 44% defining their race as black, 68% classifying as single and 68% being female. Many are likely to have one kid. And here is a bit more about that group:

Most Watched Shows: Living Single, Peppa Pig, Paw Patrol, Married at First Sight, Fatal Attraction, The Fresh Prince of Bel-Air, Family Feud, The Cosby Show, The First 48, and Law & Order.

Top Philo Channels Watched: BET Her, ID, Lifetime, nick jr., and VH1.

Top Media Sites They Visit: Instagram, TikTok, and Pinterest.

Other Streaming Services They Subscribe to: Paramount+, STARZ, and Hulu.

Brands They Like: McDonalds, Southwest Airlines, T-Mobile, Uber, and Cash App.

It's interesting that there are few new shows on the most-watched list. Although given that many of them are subscribing to Starz, they are likely doing so in part because of original Starz programs such as the Power franchises.

I'll have some additional breakdowns coming in future newsletters as well as interview with someone from Philo's marketing and analytics teams.

WHIP MEDIA STREAMING ORIGINALS WATCH REPORT

ODDS AND SODS

* The good news for fans of Amazon's A League Of Their Own is that the streamer has ordered a second season. The bad news is that the season order is only for four episodes. But at least this will allow the show to wrap up with an actual finale of sorts.

* Here are some photos from SXSW premiere of Apple TV+'s new drama The Big Door Prize.

* The quasi-true crime special TMZ Investigates: 9/11: The Fifth Plane premieres Monday, March 20th on Fox.

* Today's 70's Song You Should Know (sponsored by Spotify) is "Hello And Welcome Home" by The Rollers.

* A look at which broadcast TV shows are getting the best delayed-viewing gains.

A LOOK AT NETFLIX'S BIGGEST RIVAL IN THE MIDDLE EAST

The Shadid streaming service isn't well known in the U.S., in large part because while it is available across the globe, the majority of subscribers for the Arabic content streaming platform are located in the Middle East. Shadid is headquartered in Dubai, United Arab Emirates and Riyadh, Saudi Arabia and has become a force in the region with a combination of originals, live sports and regional channels, as well as a focus on Ramdan.

Shadid is owned by MBC, the region's largest broadcaster, and Variety's Nick Vivarelli has a really informative interview with MBC CEO Sam Barnett:

Tell me more about MBC’s pan-Arab scope

I’ll give you a few examples. The largest show that I think has ever been on an OTT in the Middle East is a show called “Heera.” It’s an Iraqi soap opera and it’s hit the ball out of the stadium in terms of all the other numbers we’ve ever seen.

We’ve just done Season 2 of “Casa Street” in Morocco. Again, probably one of the largest and most popular series in Morocco. And in Egypt, we have probably our biggest drama in Ramadan, a show called “Al Aghar” with Amr Saad, and we have out a normal prank show with Ramez Galal. That’s important because Egypt is going through economic challenges at the moment. But we are doubling down there. And we are still number one there and have made a commitment to Egypt. So we are still as Pan-Arab as we ever were. Our biggest content on air right now is called “Al Thaman” (produced in Lebanon and Turkey) which is an “Indecent Proposal”-like story, but over 150 episodes. It’s a pan-Arab product and it’s as popular in Musket as it is in Marrakesh. And it also works very well in Saudi.

I don't think you effectively talk about the North America streaming business without understanding the forces the shape the industry in the rest of the world. Shadid, Showmax, Hotstar, Viu, iQiyi, Viki, ALTBalaji, Viaplay, Zee5 and others are all major regional players, albeit much smaller than Netflix and Prime Video. I spend as much time as possible trying to write about these streamers, but I'm happy to see the Hollywood trades expanding their global coverage.

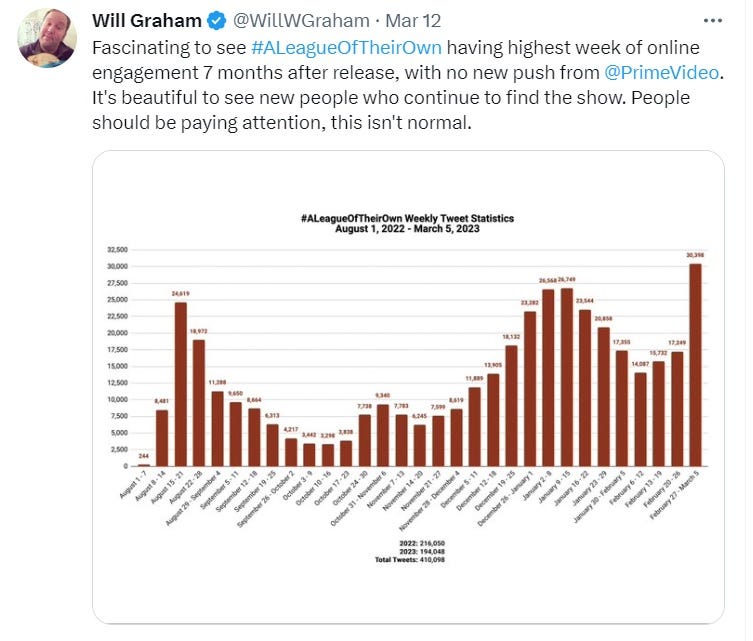

TWEET OF THE DAY

WHAT'S NEW FOR TUESDAY:

Ariyoshi Assists (Netflix)

Bert Kreischer: Razzle Dazzle (Netflix)

Gotham Knights Series Premiere (The CW)

Return To Amish Season Premiere (TLC)

Superman & Lois Season Premiere (The CW)

Super Turbo Story Time Series Premiere (Motor Trend)

Click Here to see the list of all of the upcoming premiere dates for the next few months.

SEE YOU WEDNESDAY!

If you have any feedback, send it along to Rick@AllYourScreens.com and follow me on Twitter @aysrick.