Too Much TV: Your TV Talking Points For Friday, August 12th, 2022

When you're a hammer, everything looks like a nail: the streaming edition

Here's everything you need to know about the world of television for Friday, August 12th, 2022.

WHEN YOU'RE A HAMMER, EVERYTHING LOOKS LIKE A NAIL: STREAMING EDITION

While the phrase "when you're a hammer, everything looks like a nail" is trite and over-used, it is also a very accurate representation of human behavior. No matter how smart we may be or the level of our expertise, we all struggle to not to get distracted by our biases.

That's certainly the case when it comes to the streaming video industry. The business continues to change and evolve at an exhausting rate and as we are frantically forced to move into new territory, it's impossible to know which path is the correct one. And there is something about uncertainty that brings out stubbornness in all of us.

There is also a tendency to want to frame these complex decisions as black and white issues. Linear TV vs. streaming. Warner Bros Discovery vs. Netflix. Theatrical releases vs. streaming only movies. And those types of stark comparisons draw traffic to your site or subscribers to your newsletter. No one wants to read a hot take with a headline along the lines of "Everything in the streaming business is a shade of grey," even if that is the most accurate take of the industry right now. That's not to say that journalists who write these things don't believe what they are saying. But there are also strong incentives to strip away as much nuance as possible from your point of view.

I have recently found myself going back-and-forth on social media and in email with some industry reporters and analysts who disagree pretty strongly with my take on the state of the industry. I get accused of being a Netflix bull, of not understanding the numbers that make the new Warner Bros. Discovery move away from straight-to-streaming releases a thing of the past. I like a good argument, but it's frustrating to see my point of view being misrepresented. Especially since it's also clear from my emails and DMs that my point of view on the industry is one held by a fair number of other people.

Given all of that, I wanted to uncharacteristically spend a bit of space in this newsletter talking about how I see the industry. I'm not arguing that I am correct about everything. In fact, I can pretty much guarantee that I'm not. But my worldview about the industry is one that I think makes a lot of sense.

I'm not a Netflix superfan and in fact, I've been pretty critical of the company over the past several years. To the point that I have fielded calls and emails from unhappy Netflix executives and PR people who disagree with my point of view. Yes, I thought the company’s stock was overvalued but I also think the market has over-corrected the company's stock price at this point. I believe the company often drops the ball with the PR and marketing efforts. But I also believe they understand the potential of global production as well as anyone in the industry. And even though their rate of content spend has bordered on being financially dangerous, I don't see any other option if they want to survive independently in the long term.

But while I'm not a Netflix bull, I am extremely bullish about the streaming video business in general. Yes, the financials are generally terrible right now. But that is almost always the case with relatively new industries that are still figuring out the parameters of what is possible. I wrote a couple of weeks ago about the "Innovator's Dilemma:"

"The Innovator’s Dilemma comes from the paradox created by success. The decision-making process and the allocation of resources that lead to success can be limiting when it comes to embracing innovation. When confronted by disruptive technology, companies often fall into comfortable boxes. They talk to their customers, who tell them there’s no need to change."

For all of the challenges that come with the streaming video business, I also believe it's the future of the business. The linear business may remain a moneymaker for years, but it's a declining business with fewer customers every year. Many of those customers are only there because of lethargy and involuntary bundling that makes it difficult to break components apart and just subscribe to the stuff they care about. The linear business is always going to be there. But it will someday be the video equivalent of the album business.

And that is a core problem I have with David Zaslav and his vision for what Warner Bros. Discovery should be. He and his advisors see streaming as merely another component of the business, as opposed to a platform that is going to permanently alter the entertainment industry's business model. He struggles with understanding how otherwise successful companies can seemingly do everything right and still lose market share:

"...large incumbent companies lose market share by listening to their customers and providing what appears to be the highest-value products, but new companies that serve low-value customers with poorly developed technology can improve that technology incrementally until it is good enough to quickly take market share from established business. Christensen recommends that large companies maintain small, nimble divisions that attempt to replicate this phenomenon internally to avoid being blindsided and overtaken by startup competitors."

The ultimate question is less about this company vs. that company and more about how you see the industry's future. Yes, you can certainly make more money in the short-term with longer theatrical windows, smaller content spends and a focus on traditional revenue streams.

But my contention - and it's one that has a lot in common with what drove Jason Kilar when he was at Warner Brothers - is that there is no easy way to get from here to there. If you truly believe that streaming is where the industry is headed, you can't successfully finesse the disruption. If you look at the case studies of other industries that have undergone such a massive sea change, the best way to navigate through the pain is to sprint forward towards the far side of the chasm, burning the bridge behind you.

David Zaslav doesn't believe in that approach, and he has enormous financial incentives to delay the inevitable corporate pain for as long as possible. He is already one of the highest-paid CEOs in any industry, but last year was granted $203 million in stock options that he will only receive if the price for Warner Bros. Discovery shares rises substantially in the next several years. That provides a strong incentive for Zaslav to lean into his strategic tendency to go back to the future and rely on the traditional business model for as long as possible. Because cutting costs and boosting short-term revenue is the best way to please investors who are focused on the current quarter's results and bottom line.

One criticism I have heard about this belief is that other industry CEOs such as Reed Hastings are also focused on stock prices, so what is the big deal? But no other CEO has such a massive incentive to juice the stock price in the short to medium term. Zaslav is an old-school TV guy who has made his career optimizing revenue in a predictable entertainment industry. That is why he was awarded a couple of hundred million dollars worth of stock options. Because he can be counted on to be predictably cautious.

I happen to believe that being cautious is the wrong approach when it comes to a massive tsunami of change. I could be wrong. But that's my point of view and that POV is going to be heavily reflected in this newsletter.

And Monday, I'll be back with my more predictable mix of news and opinion.

ODDS AND SODS

* YouTube is planning to launch an online store for streaming video services and has renewed talks with entertainment companies about participating in the platform, according to people close to the recent discussions.

* Reality Blurred's Andy Dehnart has a great interview with Alex Guarnaschelli about her show Alex Vs. America.

* The head of Starz talks about the Outlander and Power franchises and why the service is shying away from producing more limited series such as Gaslight.

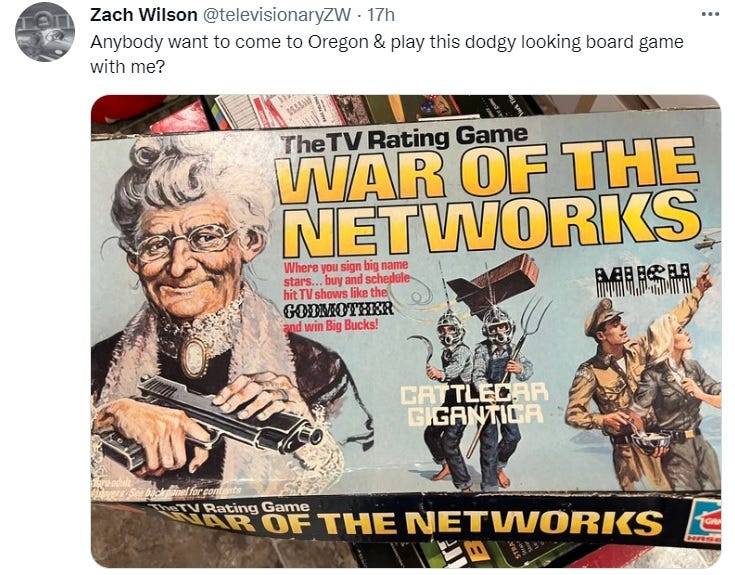

TWEET OF THE DAY

WHAT'S NEW FOR FRIDAY

Here's a quick rundown of all the new stuff premiering today on TV and streaming:

A League Of Their Own Series Premiere (Prime Video)

Alyssa Limperis: No Bad Days (Peacock)

A Model Family (Netflix)

Children Of The Underground (FX)

CMT Summer Camp: Little Big Town (CMT)

Cosmic Love Series Premiere (Prime Video)

Day Shift (Netflix)

Evil By Design: Exposing Peter Nygard (Starz)

Five Days At Memorial (Apple TV+)

For All Mankind Season Three Finale (Apple TV+)

Hamster & Gretel (Disney)

Loot Season Finale (Apple TV+)

Lucy's School (Apple TV+)

Murder House Flip Season Premiere (Roku)

Never Have I Ever Season Three Premiere (Netflix)

On Patrol: First Shift Series Premiere (A&E)

Post Malone: Runaway (Freevee)

Rogue Agent (AMC+)

RuPaul's Secret Celebrity Drag Race (VH1)

Secret Headquarters (Peacock)

Shark Side Of The Moon (Tubi)

She Is Not Your Daughter (LMN)

Slumberkins Series Premiere (Apple TV+)

13: The Musical (Netflix)

This Fool Series Premiere (Hulu)

Viagra: The Little Blue Pill That Changed The World (Discovery+)

Click Here to see the list of all of the upcoming premiere dates for the next few months.

SEE YOU MONDAY!

If you have any feedback, send it along to Rick@AllYourScreens.com and follow me on Twitter @aysrick.