Too Much TV: Your TV Talking Points For Friday, August 5th, 2022

Streaming video and the innovator's dilemma.

Here's everything you need to know about the world of television for Friday, August 5th, 2022.

STREAMING VIDEO AND THE INNOVATOR'S DILMEMMA

One thing any serious business major will tell you is that innovation is hard. Successful businesses rarely reinvent themselves, especially if it requires blowing up their current business model. It's an economic theory known as the "Innovator's Dilemma" and it was popularized in a 1997 book by Harvard professor and businessman Clayton Christensen:

"The Innovator’s Dilemma comes from the paradox created by success. The decision-making process and the allocation of resources that lead to success can be limiting when it comes to embracing innovation. When confronted by disruptive technology, companies often fall into comfortable boxes. They talk to their customers, who tell them there’s no need to change."

Christensen also talks about "disruptive technologies" and how wildly successful companies can seemingly do everything right and still lose market share:

"...large incumbent companies lose market share by listening to their customers and providing what appears to be the highest-value products, but new companies that serve low-value customers with poorly developed technology can improve that technology incrementally until it is good enough to quickly take market share from established business. Christensen recommends that large companies maintain small, nimble divisions that attempt to replicate this phenomenon internally to avoid being blindsided and overtaken by startup competitors."

I've thought a lot about both of those passages since yesterday, because I think they perfectly frame the challenge facing Warner Bros. Discovery and CEO David Zaslav. Streaming is an expensive business and in at least the short-term is likely one that loses lots of money. But it is possible to build a thriving streaming business while still protecting your core legacy linear television and theatrical businesses?

Zaslav clearly believes it is and he's betting a lot of his future stock options as well as the newly combined company on the effort. And he is not the only person who believes this is the right move.

Today, I read the latest "Screentime" newsletter from The Bulwark's Sonny Bunch and with a headline like "Is Streaming Really A Black Hole Of Financial Loss?," he clearly believes entertainment companies are spending too much money on their streaming content:

WBD reported a net loss of $3.4 billion on Thursday’s earnings call, this despite the fact that it has 92.1 million subscribers across HBO, HBO Max, and Discovery+. But WBD isn’t alone here. Peacock reported a loss of half-a-billion dollars for Comcast NBC Universal. Despite earning nearly five billion in revenue for Disney, the division of the company that encompasses Disney+, Hulu, and ESPN+ lost nearly $900 million. Whether or not Netflix is “profitable” is hard to say, given how much debt they’ve acquired and how much they’re spending on new programs and movies. But the fact that it’s even a question when the company is generating $30 billion in revenue per year—or, roughly, three times the entire domestic box office for 2019—is a bad sign for streaming as a business model.

There are all sorts of accounting tricks that can be deployed to show these losses aren’t as bad as appears and I’m sure these amortizations are all very convincing to people who “buy stocks” and “run the economy.” But from your humble critic’s point of view, it seems pretty obvious that streaming companies are simply spending too much money on too many middling-to-bad programs and movies. It’s hard to think of a better illustration of this waste than the phrase “$90 million CW pilot.”

Again, even if you don’t think WBD was right to shelve Batgirl, the new regime’s realization that streaming should serve as a, well, stream of revenue that complements, rather than replaces, theatrical revenue is a step in the right direction.r

As you might imagine, I have some thoughts. Firstly, part of Bunch's premise is based on a comment from Matthew Belloni's Puck newsletter, in which someone described the unreleased Batgirl movie as looking like a "$90 million CW pilot." I don't doubt that was their reaction, but for what it's worth, there are two things about the screening I know for sure. One is that the version that was screened was lacking a lot of the finished elements. It's not clear precisely how much, but I spoke with someone close to the production of the film earlier in the week and they estimated getting the film into a theater-ready version would likely cost another $7-10 million. So those missing elements probably didn't help the reaction. I also spoke with someone on Thursday who had seen the film and described it as "flawed, but also entertaining." That doesn't mean Batgirl was good enough to deserve even a streaming release. But it leads me to think that pulling Batgirl and the animated Scooby movie was more about capturing those $130 million or so in tax write-offs then it was about the quality of the films.

But more to Bunch's overarching point. Is it possible to build out a successful streaming platform without losing lots of money in the short and likely medium term? I think it's fair to say that nearly everyone in the entertainment business has realized streaming will eventually become a primary platform for entertainment. The question becomes "is it necessary to damage your core businesses and predictable revenue streams to get there?"

Which brings us back to the "innovator's dilemma." Go look at those two passages I highlighted above again and ask yourself if they apply to the streaming business. It's a tough call and while no one remembers the decisions that turned out to be correct, everyone remembers the missteps. It wasn't that Blockbuster executives didn't understand the potential of Netflix when they had a chance to purchase the company early on. It's that they didn't believe it would ever overtake their legacy video rental business. And on some level, they understood that in order to succeed in streaming they would have to blow up a large part of their current revenue stream, which they could not comprehend doing willingly. And so Blockbuster went out of business and Netflix is now...well, Netflix.

David Zaslav appears to see the potential of streaming, but he also pictures himself as an old-school entertainment mogul. He has surrounded himself with a lot of familiar Hollywood faces at WBD and he clearly loves the idea of being the head of a multi-platform media giant. He and his advisors are convinced they can hedge their bets moving forward. Cut expenses deeply (which includes content spend) and maximize revenue from legacy markets. At some point streaming will be a cash-positive business, but until then, a lot of the new content is going to come from windowed theatrical movies, HBO and co-production originals and the linear Discovery networks.

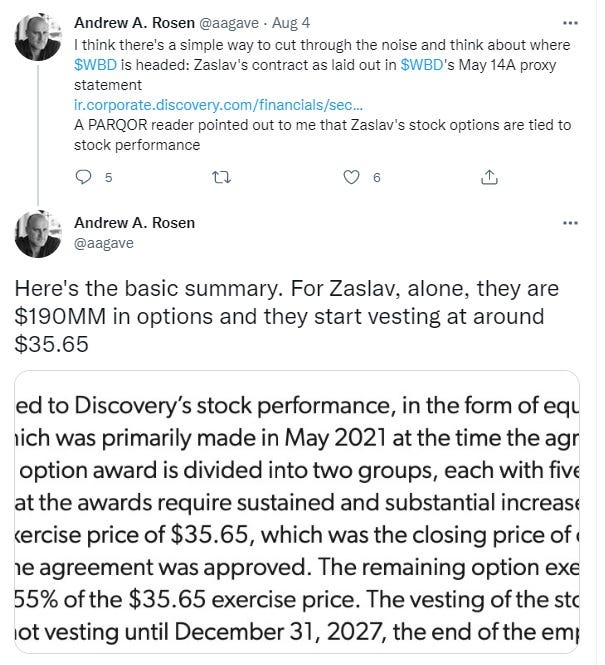

It's a direction he truly believes is the correct one. But cynically, he also needs to do whatever he can to push the Warner Bros. Discovery stock price up to a range where he can collect his stock options beginning on January 1st, 2025:

The question of the year is whether Zaslav's vision is correct. Is Warner Bros Discovery the next IBM, a company that survived but ceded its once-dominant position in personal computers to rivals? Or is it Apple, which has managed to navigate changes in the business that nearly put it out of business before evolving into a money-printing machine?

If anyone tells you they know for sure, they're an idiot. All of us are just looking into our crystal balls and using our best instincts to tell us what we suspect will happen over the next 5-10 years.

But this is what I know from my perspective. Putting aside the IP and other aspects of both businesses, if I had to choose between the WBD approach to streaming and the one being pursued by Netflix, I'd go with the upstart. Granted, they have massive management and strategic issues of their own. But I'd rather run a fully-built out global entertainment streaming business than one in which you're trying to juggle the needs of the legacy business with the challenges of a building a global streaming business.

TWEET OF THE DAY

WHAT'S NEW FOR FRIDAY

Here's a quick rundown of all the new stuff premiering today on TV and streaming:

Carter (Netflix)

Darlings (Netflix)

Faith (Film Movement Plus)

Jesus Sepulveda: Mr. Tough Life (HBO Max)

Killer Camp (The CW)

Lego Star Wars: Summer Vacation (Disney+)

Lies Beneath The Surface (LMN)

Luck (Apple TV+)

Physical Season Two Finale (Apple TV+)

Prey (Hulu)

Recipe Lost & Found Series Premiere (Discovery+/Magnolia)

Rise Of The Teenage Mutant Ninja Turtles: The Movie (Netflix)

Stowaway (AMC+)

The Outlaws Season Two Premiere (Prime Video)

The Sandman Series Premiere (Netflix)

The Snoopy Show (Apple TV+)

They/Them (Peacock)

Thirteen Lives (Prime Video)

Click Here to see the list of all of the upcoming premiere dates for the next few months.

SEE YOU MONDAY!

If you have any feedback, send it along to Rick@AllYourScreens.com and follow me on Twitter @aysrick.